Navigating the Shifting Tech Talent Landscape in 2024

The tech industry is no stranger to rapid evolution, and 2024 has been a year of both turbulence and opportunity for tech professionals. In a recent report from Dice on their Tech Sentiment Report, experts explored the latest data trends and sentiments shaping the tech industry. Here are the major insights:

A challenging market with signs of hope

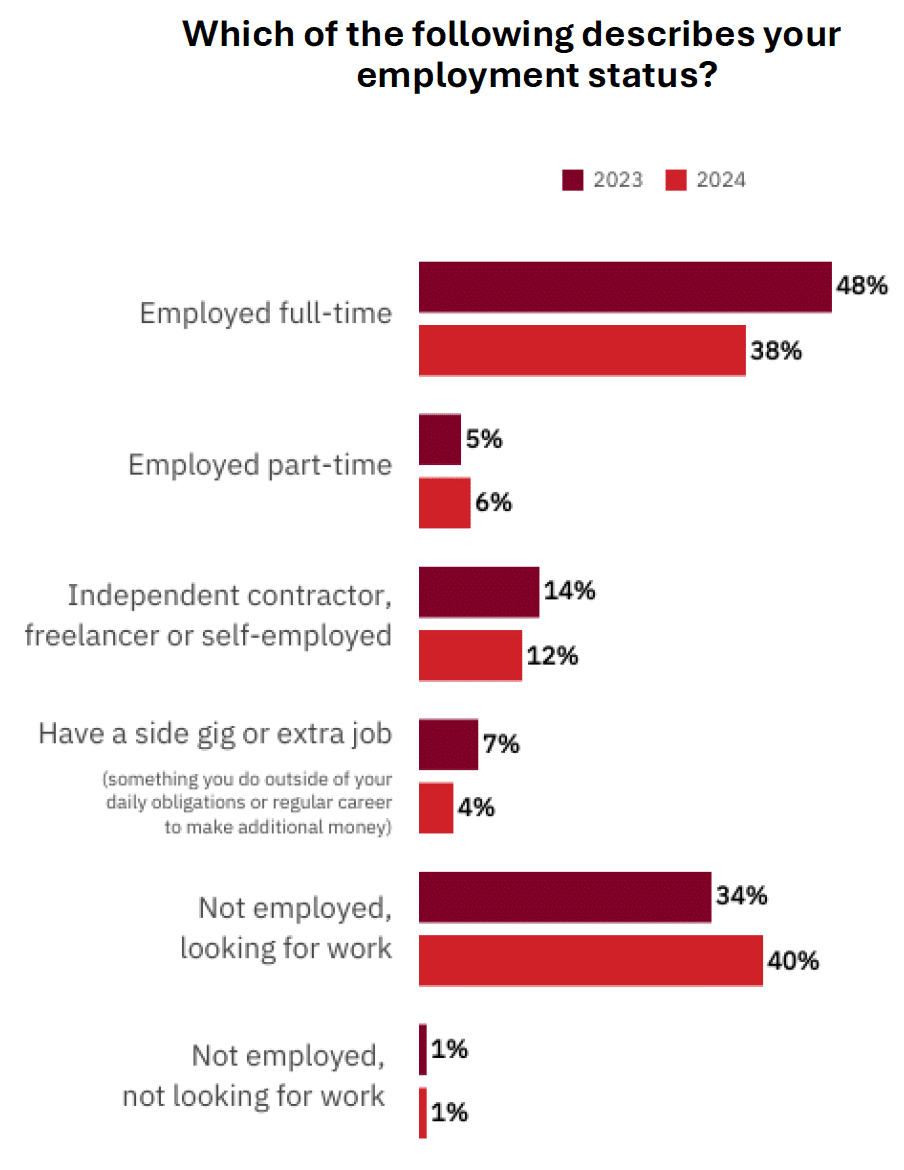

The past year has seen significant layoffs in tech, with 60% more professionals losing their jobs in 2024 compared to 2023. Notably, tech companies themselves faced more cuts (19%) than non-tech firms (11%). Despite these setbacks, tech professionals have not lost hope; instead, many are actively re-entering the job market, driven by both necessity and resilience.

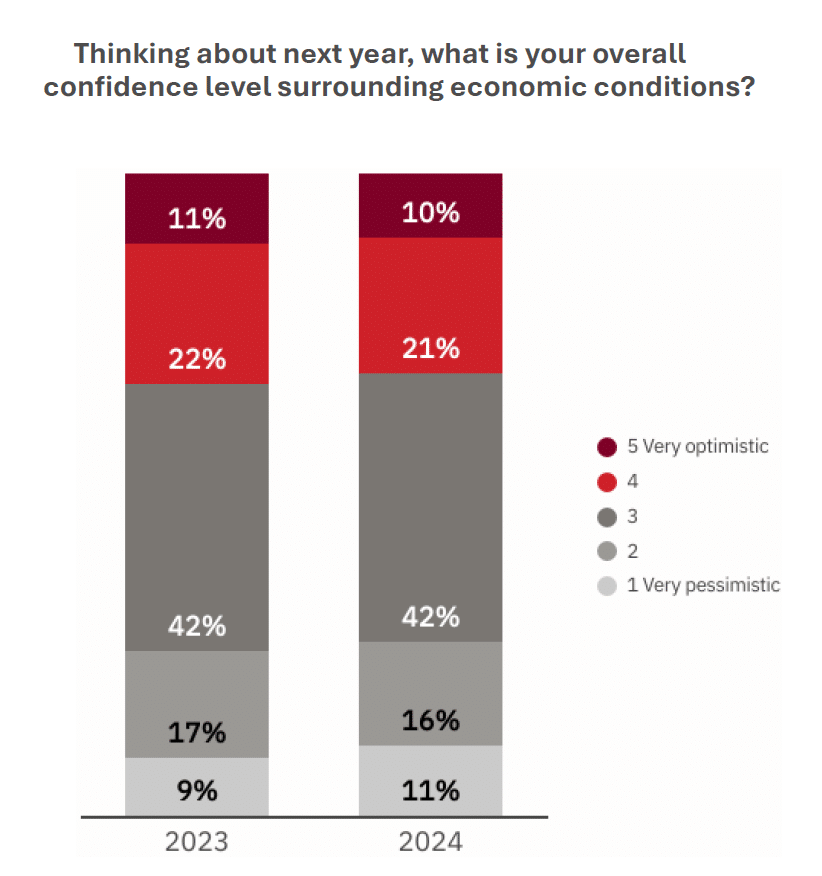

Mixed economic sentiment with a long-term positive outlook

While only 31% of tech professionals feel optimistic about short-term economic conditions, a striking 80% believe the tech industry will grow over the next five years. This demonstrates that while immediate challenges exist, the long-term trajectory of tech remains robust. Professionals aren’t looking to exit the industry; they’re preparing for the next wave of growth.

Increased job-seeking and mobility

A striking 67% of tech professionals are considering new job opportunities, up from 60% in 2023. This figure includes both employed and unemployed individuals. For recruiters and hiring managers, this presents a golden opportunity for outreach, as many are open to new roles.

Shifting trends in Tech Staffing

Though the past couple of years have been tough for tech staffing, industry forecasts show a potential rise of 7% in 2025, following a 5% downturn this year. This uptick is already visible, with early signs of market recovery noted, including a drop in the tech unemployment rate from 3.5% to 2.5%.

Sector-specific performance insights

While large software firms dominated headlines for their layoffs, other tech sectors showed resilience and growth. Engineering roles related to chip manufacturing, automotive innovations, and healthcare IT have outperformed expectations. Healthcare IT and finance-specific tech roles have shown strong market performance.

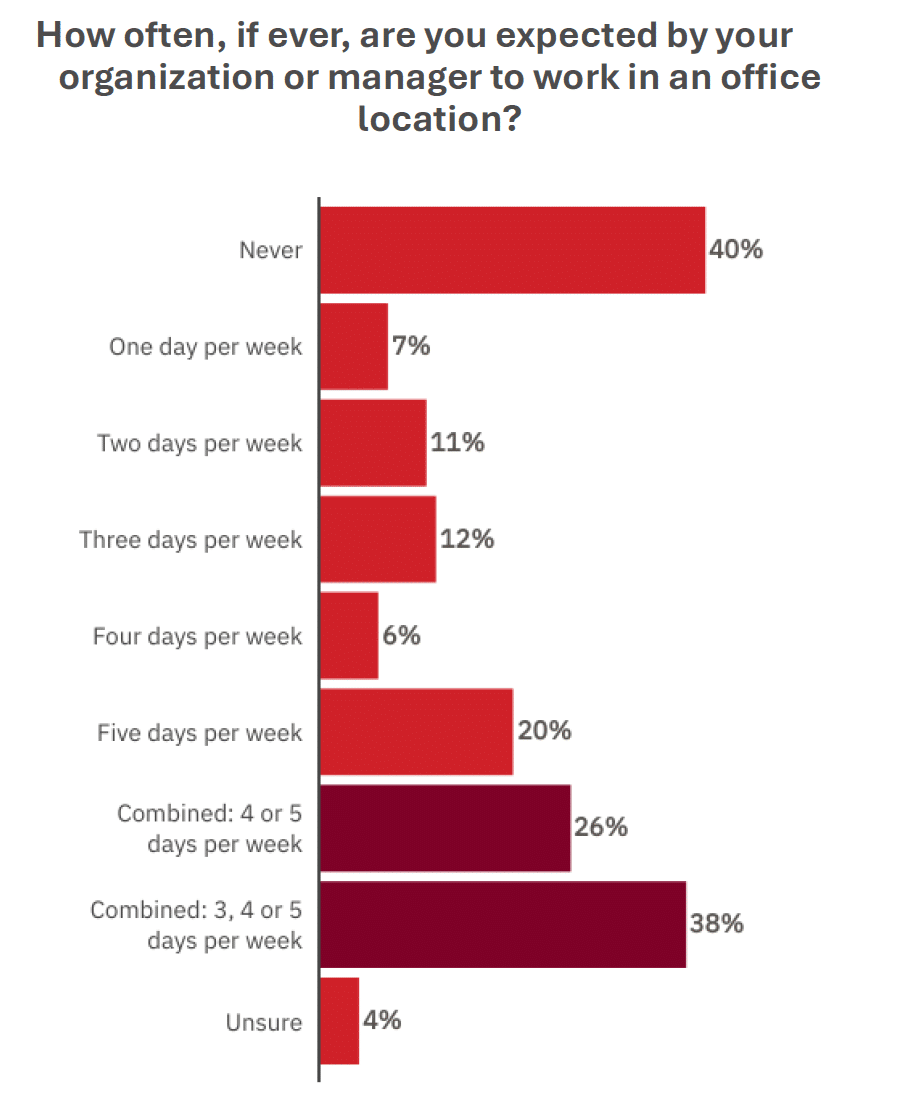

The strong preference for remote work

Unsurprisingly, 9 in 10 tech professionals cite remote work as a significant factor when evaluating new job opportunities. The desire for remote flexibility has persisted since the onset of the COVID-19 pandemic, with dissatisfaction notably higher among those required to be in the office at least one day per week. This underscores the importance of offering and communicating flexible work arrangements to attract top talent.

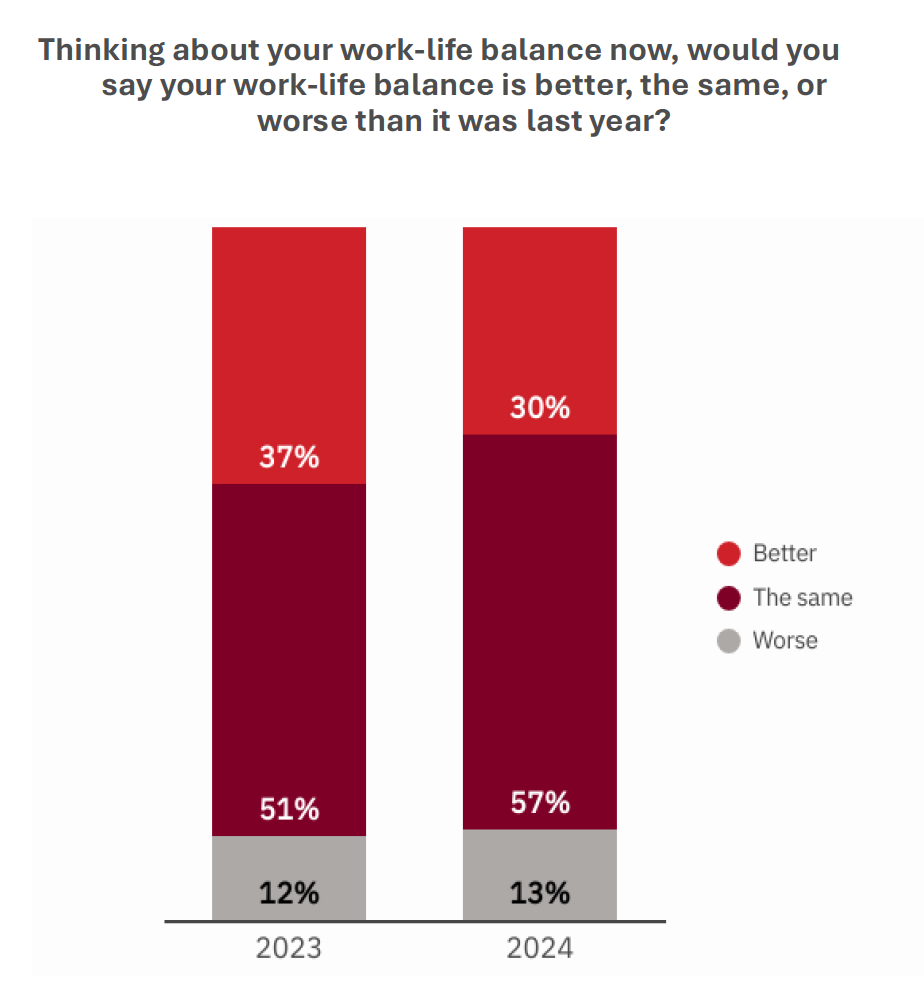

Burnout and the work-life balance

A concerning 31% of tech professionals report experiencing burnout, largely fueled by unfair pay, toxic work environments, and lack of recognition. This is further compounded by increased workloads resulting from layoffs and staff reductions. Companies that address these challenges by prioritizing work-life balance and employee well-being can position themselves as more attractive employers.

The hybrid work debate

While 87% of employers favor hybrid work, many struggle to find alignment with employee preferences. The key lies in clearly defining what “hybrid” means for each organization, as vague policies often lead to frustration. For recruiters, understanding and communicating these nuances can bridge the gap and foster stronger connections with candidates.

Compensation and career growth

Despite shifts toward work-life balance, 65% of tech professionals seek higher compensation as a top motivator for changing roles. Other significant factors include greater responsibility (42%) and improved benefits (36%). Balancing these desires with realistic expectations around compensation and company culture can help recruiters present compelling opportunities.

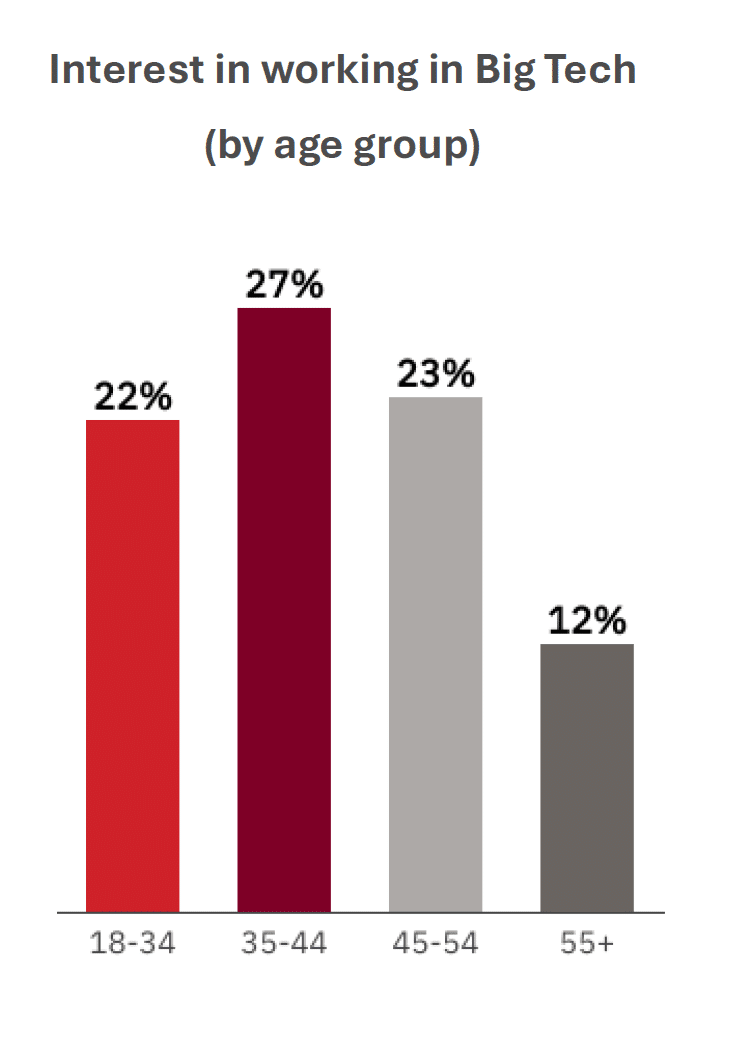

Employer branding and industry preference

Nearly 70% of tech professionals still prefer to work for tech companies, despite recent layoffs. Interestingly, 21% specifically desire roles in big tech due to their perceived prestige. This highlights the ongoing importance of employer branding and showcasing a company’s unique value proposition, especially when competing with industry giants.

Lithium remains committed to bridging gaps in the tech talent landscape by connecting LATAM’s best talent with global opportunities. Stay tuned for further insights from this informative series.